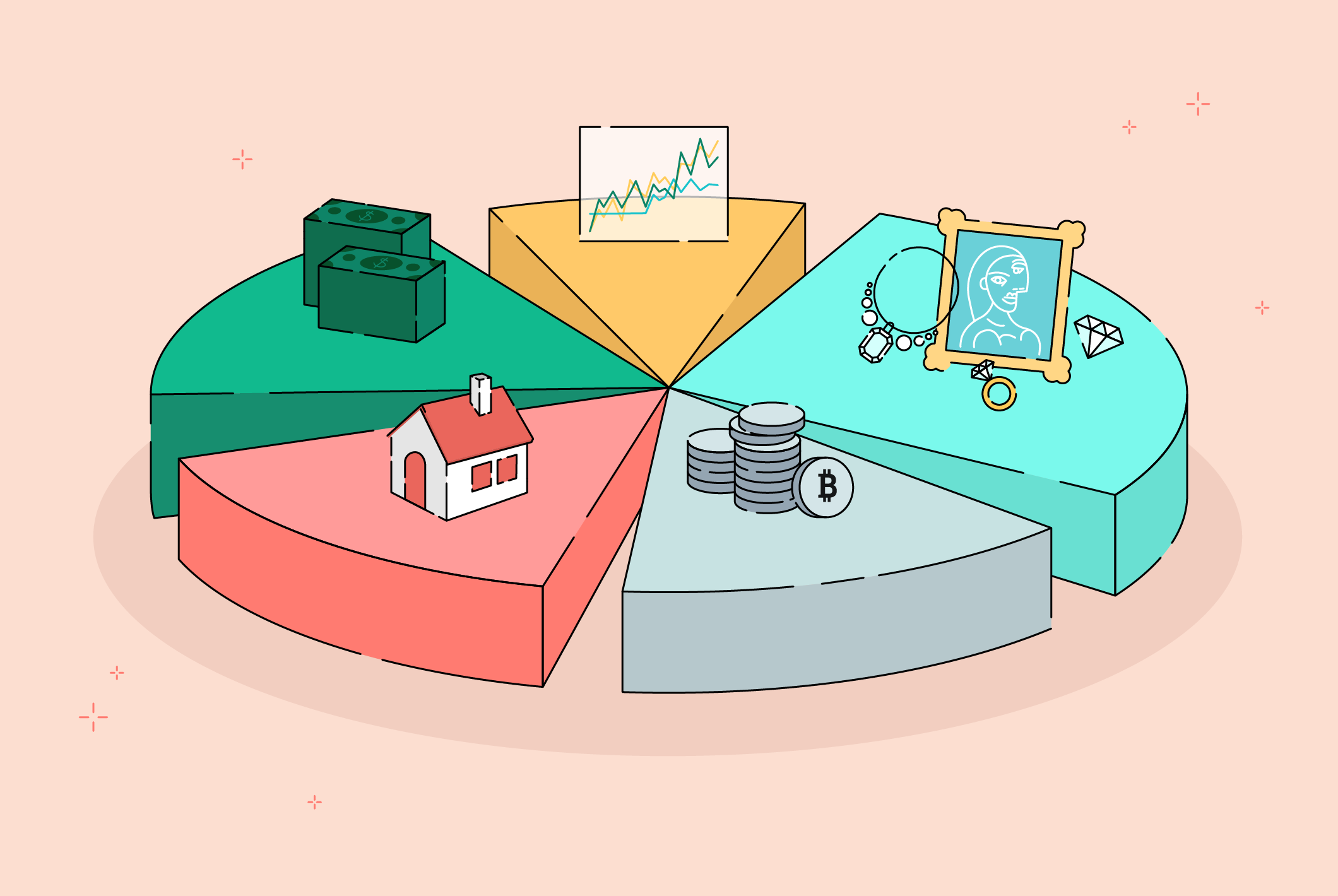

When you invest in multiple assets, such as stocks, real estate, and bonds, your overall portfolio value is more stable. The key to successful diversification is ensuring that the various investments are equally weighted. If one asset is more heavily weighted than another, it could become a source of risk for investors. Diversification also helps prevent you from having too much of one asset at the expense of another. SWK Holdings experts can help with this.

Benefits of Diversifying Assets

Control risk

Diversification can help reduce the impact of single-asset losses. For example, if you have stocks that are down 20% and bonds that have lost 10% over the same period, your overall portfolio may have lost a little less than 10%. However, if you had a few investments in each category, such as stocks and bonds, you could theoretically lose up to 30% without affecting your overall net worth too much. Stocks and bonds are more volatile than other investments like real estate or cash, so diversifying them helps mitigate some of their risks over time.

Greater Returns

Diversification can increase total returns on an investment by lowering the risk of failure and reducing the chance that one investment will be adversely affected by another. For example, if you invest in stocks and bonds, you might find that one particular stock or bond is hit hard during a downturn and is subsequently unable to recover. You may lose all your money invested in that asset class if this happens. Diversifying your investments can reduce this risk by making sure that other investments are available with different markets and risks so that if one particular asset class suffers a loss, the others will not be affected as much.

Lower volatility

Diversification reduces your portfolio’s volatility by spreading your investments among different asset classes. If you have a large amount of money invested in one company or industry, a downturn in that sector can cause your portfolio to lose money. By spreading your investments across different sectors and industries, you reduce the chances that one industry will suffer from an economic downturn or other types of negative events. This means you’ll have less risk than if you concentrated only on one area or industry.

Diversifying assets also helps reduce your portfolio’s overall volatility because each asset can be used to offset losses from another asset class. For example, if a stock market crashes and drops 20% over a short period, you could use bonds to offset some of those losses because bonds are more stable than stocks during bad times, which makes sense because they’re long-term investments.

The first benefit of diversifying assets is to keep capital safe. It is crucial to ensure that you have a diverse portfolio with different investments. Having a portfolio filled with only one type of investment can be dangerous if the market suddenly takes a turn for the worse.

Protect against market fluctuations

Diversifying your investments can also help protect you against market fluctuations. This is because some investments are more volatile than others and tend to decline more dramatically when the market dips or rises. By spreading out your risk among several different types of investments, you will reduce the impact that severe market drops have on your overall portfolio value.

Build wealth over time

Diversifying your investments helps build wealth over time by helping you grow your money steadily instead of having it all come crashing down as it might with a single investment in one company or industry sector. When you have several different types of assets in your portfolio, each one will contribute differently to the overall value of your portfolio over time, as well as provide other benefits such as income.

Bottom line

Diversification is a way to keep your capital safe. It’s not just about avoiding the risk of one type of investment going down but also about spreading the wealth across different investments with varying degrees of risk and return.